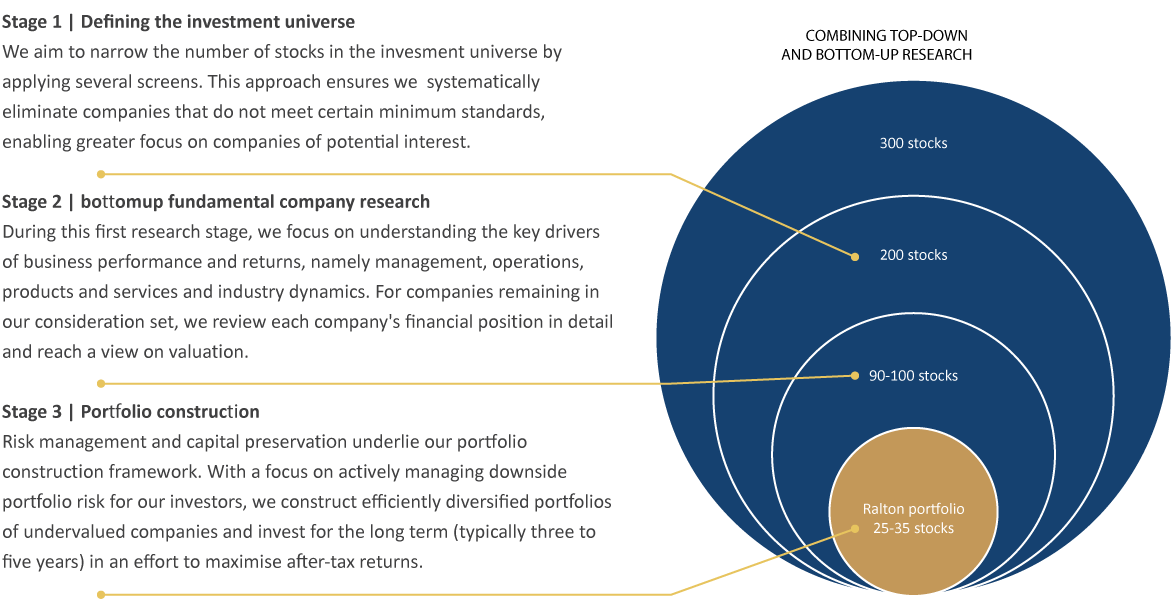

Combining top-down and bottom-up research

Intensive bottom-up research is the cornerstone of our process which we supplement with top-down thematic views.

Disciplined and consistently applied, we use several proprietary qualitative and quantitative techniques to scrutinise companies to uncover undervalued businesses.

We look to invest in companies with:

- strong and reliable management

- good profit and dividend growth expectations

- reasonably predictable future profits and cash flows, and

- clear business models.

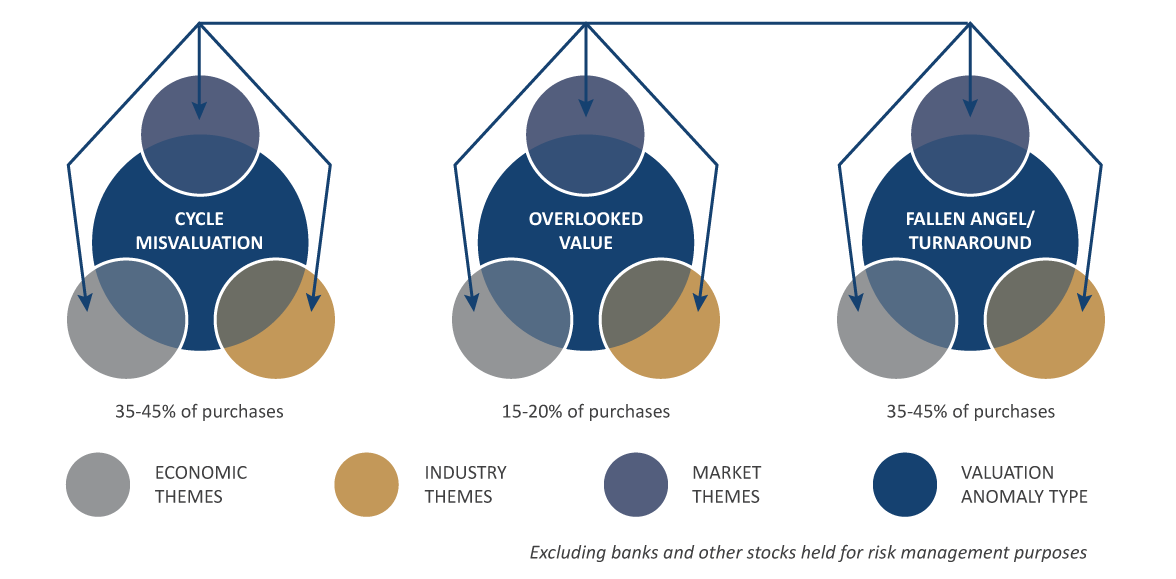

Constructing portfolios

We aim to find the intersection between value and themes.

“Companies remaining in our investment universe after stage 2 we construct into a portfolio that displays a value bias. The depth of the bias will vary over the market cycle. This is done in acknowledgment that the market displays different trends throughout the economic cycle.”

Environmental, social and corporate governance

What we look for

Demonstration of desire and ability to limit/reduce environmental impact.

Example: Tassal

Strong, proactive adherence to environmental standars and sustainable fishing methods, culminating in WWF accreditation. This strategy raises the barriers to entry and supports pricing for a ‘premium food’ category.

What we look for

Recognition of the interest of the broader stakeholder interests.

Example: Oil Search

Over many years, OSH successfully managed all stakeholders (landowners, global oil major, contractors) to deliver a world-class LNG project in the remote highlands of PNG. This

included community aid and infrastructure – avoiding the Bougainville Copper issues.

What we look for

Proactive applications of best-practice governance principles.

Example: G8 Education

Despite the appointment of a new Chair and top-four auditor, the board agreed to allow the CFO to engage in what appeared to us as ‘related party’ arrangements. This was a key factor in our sell decision.

Socially responsible investing

When investing your money in a public company, you are trusting company management to do the right thing by you. So, assessing a company’s governance should be and is a critical component of our investment decision process.

What do we mean by governance? Governance is an evolving concept, but today it would include:

- the prudence exercised around executive remuneration, including share option issues

- the recognition of the legitimate interests of minority/external shareholders

- sound systems of internal controls for risk oversight and the timely disclosure of matters to the market, and

- systems to identify conflicts of interest and to safeguard against bribery and gratuitous payments.

Governance is an evolving state, so we work to keep abreast of what is viewed as best practice. If we went back to the 1980s, there were many related-party transactions between companies and their directors and management. As a first step, a requirement to disclose these transactions was introduced and then investors agitated to see their elimination. Now, we are considering whether the appropriate systems are in place to detect and ensure such transactions are appropriately reported.

However, rules will not stop poor behaviour: people will find a way around them if they want to. Therefore, we consider the ‘spirit’ of the way management and boards comply with the requirements and not just the letter of the law, often judging their actions when events go awry. At a level, this involves having a view on members of the board, and particularly the chairperson, to drive a culture of responsible and ethical decision-making.

There are several companies we choose not to invest in given the disregard a major shareholder, management or board has shown to external investors in the past. You build a knowledge about individuals in the market over time and can avoid those who have not stuck with the spirit of the rules.