20 August 2015 | Andrew Stanley, Head of Investments, Ralton Asset Management

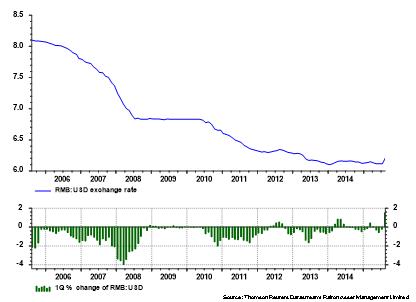

China shocked the world last week by allowing the renminbi to devalue by a small amount for three consecutive days. Unsurprisingly, commentators began asking whether this was a sign of crisis or simply the People’s Bank of China’s (PBOC) desire to facilitate its evolution as an international reserve currency.

While we believe it’s a combination of the two, the true picture will emerge over the coming months. With China experiencing a deflationary bust as years of debt-fuelled growth come to an end, the internationalisation of the renminbi is one of the components of the medium-to-long-term transformation of the Chinese growth model. In the short term, however, a devaluation of the currency may assist domestic GDP growth by boosting export competitiveness, as well as ease the pressure from capital flight (all other things being equal).

Renminbi internationalisation

China’s leaders want to make the renminbi an international currency to reflect the country’s global position, which means future trade with China will be done in the Chinese currency. For foreigners, it means they’ll need to be able to borrow in renminbi, while foreign central banks will need the ability to buy renminbi assets, that is bonds, to hold in reserve for trade purposes. To facilitate this, China has so far:

- expanded the capacity of foreign banks to trade in the renminbi

- introduced the Panda bond market to allow borrowing, and

- started a new international development bank (which Australia has joined) where funds will be advanced in renminbi.

One of the targets of China’s leadership has been to have their currency included in the Special Drawing Rights (SDR) (a basket of key international currencies) created by the International Monetary Fund (IMF). China followers had taken the view the renminbi would be held stable against the US dollar until a decision was taken by the IMF in late 2015 to include it in the SDR. After that, an adjustment may be made to improve the competitiveness of Chinese exporters against those in Europe and Japan. The SDR inclusion will now likely take place from September 2016 at the earliest.

Short-term growth

According to official reports, China’s GDP growth rate is running at around 7% per annum, yet many observers believe the rate to be far lower, at around 4 or 5%. For many years, China has relied on debt-fuelled growth to propel its economy forward, however, this model has now arguably reached its use-by date.

In 2014, Ralton Asset Management produced a report about the need for China’s devaluation of the renminbi should the country not want to take the full impact of the changes in capital outflows domestically. Read report here

The key to understanding how debt has been created in China is tied up with the surplus on the Balance of Payments and, without other adjustments, the shrinkage in this surplus has led to a slowdown in money-supply growth (it’s estimated China has experienced private capital outflows of approximately US$800b[1] in the past five quarters). Effectively, the hole left by capital outflows, we believe, mostly plugged with offshore borrowing. In a country dependent on debt-driven growth, these outflows aren’t good for growing the economy.

So, how does it play out from here?

The PBOC has now changed the mechanism for setting the price of the renminbi against the US dollar. As a minimum, we would expect the PBOC to continue to ease domestic interest rates while the US Federal Reserve is likely to increase rates later in the year. This would suggest the renminbi should continue to ease. However, if growth is slowing faster than the central government would like, we’ll potentially see a faster easing in the currency to stimulate export growth.

Overall, we are of the view the PBOC needs to devalue substantially, with it simply being a question of how long until it happens. With China in the early stages of a deflationary bust, its options are limited unless it wants to take all the pain domestically of a shrinking money supply from capital outflows.

Potential implications of a substantial renminbi devaluation

- China could export disinflation to the rest of the worldNot something an over-indebted world needs and which will most likely contribute to ongoing downward pressure on bond yields in the rest of the world.

- Continued downward pressure on commodity pricesFirst, as the US dollar continues to push higher, commodity prices are likely to remain under downward pressure. Second, if commodity prices don’t fall to compensate for the renminbi decline, demand in Chinese exports is likely to reduce as steel mills will have little capacity to pass on higher input costs.

- Continued weakening of the Australian dollar against the US dollarAustralia’s terms of trade are likely to continue to decline as a result of the ongoing fall in commodity prices. This, however, may prove to be a boon for Australia’s tourism and education exports.

In the short term, we’re likely to see more capital flight from China into Australian hard assets with demand for Australian real estate likely to continue unabated. Similarly, inflows to Australia may act as a temporary prop to the Australian dollar.

Contact us

For more information, contact John Clothier, General Manager, Distribution on +61 408 488 549.

For media enquiries, contact Sam Cole, Chief Operating Officer, on +61 3 9602 3199.

This article is for general information purposes only and does not take into account the specific investment objectives, financial situation or particular needs of any specific reader. As such, before acting on any information contained in this article, readers should consider the appropriateness of the information to their needs. This may involve seeking advice from a qualified financial adviser. Any opinions or recommendation contained in this article are subject to change without notice and Copia Investment Partners Ltd (ABN 22 092 872 056) (Copia) is under no obligation to update or keep any information contained in this article current. Copia holds AFSL no.229316.

[1] Lombard Street Research as quoted in The Telegraph, ‘Red capitalism hitting the wall – $800 billion capital exodus in last five quarters’, by Ambrose Evans-Pritchard, 24 July 2015